By Michael Gerbick, President, Young & Associates

On Thursday, November 7, 2024, Jerome Powell and the FOMC (Federal Open Market Committee) announced a 25 basis point (bp) interest rate reduction of the federal funds rate just after they announced a 50 bp cut in September. September’s rate reduction was the first time since March 2020, the Fed has cut rates. Consider the last several years regarding interest rates: rates dropped to zero in the face of a pandemic, rates skyrocketed 550 bps resulting in an inverted yield curve spanning years, and now another shift in monetary policy.

To provide a visual display of this environment, please view the yield curve over the last few years and then just after the announcement of the latest rate cut on November 7, 2024. Between July 2022 and August 2024, the 10-year bond yield was less than the 2-year yield indicating an inverted yield curve. You can see in the November 8, 2024 curve, the yield on the 2-year bond below the 10-year. The shift in the yield curve has been incredible. Consider the decisions made around each of these points in time at your institution.

This rate environment and the decisions made within it are impacting banks everywhere, especially community financial institutions. Decisions on how best to retain and grow deposits have impacted balance sheets and income statements during this time. It is well-known consumers were placing their money in certificates of deposit (CDs) as rates rose and continued to move their funds to these higher yielding deposit accounts, even after the Fed’s last hike in 2023. The charts below utilize call report information from S&P Global for commercial banks and reveal the deposit mix shift from non-maturity deposits and CDs from the last year. Segmenting CD deposit data from commercial banks by asset size, one can see the shift in the deposit mix for the community banks less than $1B has been the most significant.

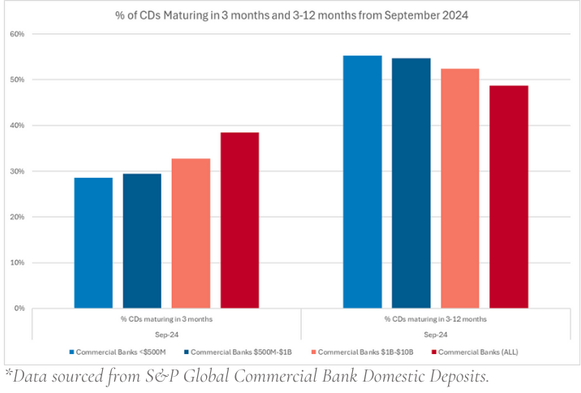

These CDs will mature; the following chart shows the majority of these maturities will take place in the next year (+84%), with nearly 30% maturing by year end 2024.

The deposit shift to CDs is not only more costly to community financial institutions, raising their cost of deposits and ultimately adding pressure to their Net Interest Margin, but they can also be more volatile than traditional non-maturity deposits with savvy depositors more willing to move their deposit relationship to the institution with the highest yielding return. In addition, the data in the charts show this deposit shift is more significant for the smaller community banks with less of an opportunity to reprice in the shorter term than the other community commercial banks.

Many of our community bank colleagues are very much aware of these rising costs and are actively pursuing all resources (including each other) on how best to manage this aspect of the balance sheet. In May 2024, the FDIC released its Annual Risk Review and in June 2024 the OCC released their Semiannual Risk Perspective both outlining significant trends and risks in the banking industry. Among the critical sections in each, the analysis of market risks stands out, particularly for community financial institutions. Both articles have common themes, I’ll break down some important insights from the reports and how they may impact your institution and its strategy in the coming months and years.

Liquidity, Deposits, & Funding: A Shifting Landscape

Reinforcing the analysis earlier this article, the OCC and FDIC both indicate 2023 saw an increase in the cost of funds for banks as community banks reacted to the rising rate environment and for more savvy consumers. For community banks, which typically have smaller balance sheets and lean heavily on customer relationships, the stability of insured deposits has been a positive. However, the growing trend of depositors seeking higher yields has led to a shift from traditional savings accounts to CDs and other high-yielding options.

This shift puts upward pressure on interest expenses, a trend community financial institutions are already feeling. In fact, CDs accounted for 26% of median of all FDIC bank deposits at the end of 2023, compared to 19% the previous year. To remain competitive and retain deposits, community banks are raising deposit rates, which in turn increases their cost of funds.

For community banks that have traditionally benefited from lower-cost deposits, this shift represents a double-edged sword—depositors are seeking better returns, but retaining those deposits requires higher costs. The challenge will be finding a balance between offering attractive rates to depositors and managing interest expenses.

Addressing Deposit Competition

To combat this competition, community financial institutions need to focus on differentiating the value they provide beyond rates. Here are some approaches you may find value in pursuing:

- Tiered Deposit Products: Offering tiered-rate accounts for different deposit levels or durations can help incentivize customers to commit their funds for longer periods while minimizing the impact on your cost of funds.

- Relationship Banking: Unlike larger institutions, community banks can leverage personal relationships with customers. Offering value-added services such as financial planning or personalized advisory services can deepen customer loyalty, encouraging them to keep their deposits with your institution even if competitors offer slightly higher rates. This applies to new lending relationships too, prioritize getting the customer’s deposit relationship as the new loan is established.

- Community Initiatives: Reinforce your brand of being an active member of the community. Consider leveraging the relationship banking discussed above; partner with these businesses to sponsor local fundraisers together. Consider avenues to reinforce your commitment to the community with other members of the community. This can not only build loyalty but also emphasize the bank’s role in the community, creating a compelling reason for customers to stay and others to start a relationship with you.

Increased Reliance on Wholesale Funding

Liquidity pressures in 2023 forced banks, especially community institutions, to turn more heavily to wholesale funding to meet liquidity needs. This is especially concerning for community banks that have historically relied on stable local deposits. The FDIC report noted that liquid assets at community banks declined alongside loan growth, driving a reliance on wholesale sources to fund assets. By the end of 2023, 19% of total assets at community banks were funded by wholesale sources, the highest level since 2017.

Wholesale funding often comes with higher costs and introduces funding risk, particularly in periods of market stress. Community banks need to carefully manage this balance, ensuring they have access to cost-effective liquidity while avoiding over-reliance on wholesale sources that could pose risks if market conditions deteriorate.

Net Interest Margins & Interest Rate Risk

Margin Compression & Variability Among Banks

Both the OCC’s and FDIC’s report make it clear that NIM compression is a concern. Although the median NIM increased slightly to 3.45% in 2023, this masks the deeper issue: funding costs—particularly deposit rates—are rising faster than loan yields, minimizing the yield gains on the assets. Many community banks saw margin compression as the cost of funds outpaced asset yields.

In the FDIC report it is highlighted that smaller community banks with less than $100 million in assets generally fared better than others, with 70% of these institutions reporting higher NIMs comparing 2022 to 2023. This is likely due to their ability to maintain stronger liquidity positions and avoid the sharp increases in funding costs that larger institutions faced. However, even smaller banks are not immune to the challenges posed by rising interest rates, and they may find their NIMs under pressure in the coming quarters as deposit costs continue to rise.

Strategies for Managing the Squeeze

- Balancing Deposit & Loan Pricing: The traditional method of managing NIM by lowering deposit rates or raising loan rates may no longer provide the same value it did in the past. Community banks can explore variable-rate loan products with rate floors, which allow for automatic adjustments as interest rates rise and have some protection as rates decline. This provides a hedge against rising funding costs.

- Dynamic Pricing Models: Incorporating dynamic pricing strategies for both deposits and loans can help strike the right balance between growth and profitability. For instance, a Midwest community bank adopted a step-up CD product, which started with a competitive rate that increased over time, providing both flexibility for depositors and predictability for the bank’s funding costs.

- Strategic Use of Securities Portfolios: To manage asset-liability mismatches, community banks can strategically deploy their securities portfolios. If the bank has excess liquidity, consider investing in current higher rate securities. Many banks invested in securities prior to the most recent rising rate environment and have unrealized losses. Although realizing significant loss on the sale of your securities is not ideal, banks should have discussions internally concerning their portfolio, payback period if a loss is realized and the most prudent path forward for their institution.

Interest Rate Risk Environment Remains High

For community banks, interest rate risk (IRR) has become an increasingly critical issue. The FDIC’s report points to the elevated share of long-term assets held by these institutions, which could constrain future NIM growth. As interest rates rose rapidly in 2022 and 2023, some community banks began selling off lower-yielding securities to reinvest in higher-rate assets. The OCC reports call out unrealized losses in held-to-maturity portfolios declined in the fourth quarter of 2023, but remained elevated at 11.5 percent. This security management strategy was mentioned earlier in this article and if implemented should be tightly monitored so as to minimize the impact and risk of any realized losses on those securities.

The OCC’s report discusses the uncertainty of the rate environment and depositor behavior prior to the Fed acting and reducing rates. It states:

Uncertainty regarding the rate environment and depositor behavior over the next 12 to 24 months increases the importance of stress testing and sensitivity analysis of deposit assumptions. Given uncharted depositor behavior and rate sensitivity observed during the recent increasing rate environment, prudent risk management would include interest rate risk and liquidity stress-testing scenarios that assume higher than expected deposit competition, resulting in higher-than-expected deposit pricing regardless of rate movement direction.

Well-developed assumptions are key to IRR management and modeling. With a declining rate environment community, banks may want to assume more conservative betas in their repricing assumptions.

Strategic Takeaways for Community Banks

So, what can community financial institutions do based on the data in the OCC and FDIC’s Reviews?

- Diversify Funding Sources: The increasing reliance on wholesale funding is costly for community banks. Banks may focus on exploring alternative funding sources or solidifying relationships with local depositors may help mitigate future liquidity pressures.

- Focus on Asset-Liability Management (ALM): With interest rate risk remaining high, it is critical for community banks to develop more dynamic asset-liability management strategies. Refining the ALM modeling deposit beta assumptions and monitoring the shift of the deposit mix can help to improve forecasts and reduce the risk of negative financial impact. In addition, reinvesting proceeds from lower-yielding securities at higher rates can help but must be carefully managed to avoid significant losses.

- Manage Interest Expenses: Even with the Fed reducing rates a total of 75 bps in the last few months, the competition for deposits remains fierce, and many community banks will need to continue offering higher rates to retain customer funds. While this will delay the full impact of cost relief from the Fed’s rate reduction, thoughtful pricing strategies and maintaining a strong loan portfolio could help offset these expenses.

From Stress to Success: Stay Agile, Stay Informed

As community financial institutions adjust to the Fed’s 50 bps and 25 bps rate reductions and face the challenges outlined in both the FDIC’s 2024 Risk Review and the OCC’s Semiannual Risk Perspective, it is clear that agility and innovation will be key to success. The market risks—ranging from deposit competition and NIM compression to liquidity pressures—are significant, but with strategic thinking and proactive management, community banks can navigate these challenges and continue to thrive. With proactive strategies focused on liquidity management, asset-liability alignment, and cost control, community financial institutions can navigate these turbulent waters and position themselves for success in 2024 and beyond.

For community banks, the key takeaway is clear: stay agile, monitor funding costs closely, and adopt risk mitigation strategies that balance growth with stability. By doing so, these institutions can continue serving their communities and remaining resilient in the face of economic uncertainty.

For over 45 years, Young & Associates has guided community financial institutions through shifting market risks. Whether it’s capital planning, liquidity management risk reviews, or interest rate risk management reviews, our team is here to ensure your institution stays agile and ready to adapt to evolving market conditions. Contact us to learn more about how we can support your success.